Running a small business requires strategic planning and careful financial management. Financial Fusion is a financial software solution designed to help small businesses streamline financial reporting, improve decision-making, and save time. In this article, we’ll explore why Financial Fusion is an ideal choice, especially with its lifetime deal, highlighting its features, benefits, and how it supports small business success.

What is Financial Fusion?

Financial Fusion is a comprehensive financial management software designed to streamline business operations. It integrates accounting, reporting, and financial data management into one platform, making it easier for small business owners to manage their finances.

Unlike traditional accounting tools, Financial Fusion offers a lifetime deal—which means you pay once and enjoy access to the software forever. This is a great option for small businesses that want to avoid ongoing subscription costs.

According to a recent survey by Small Business Trends, 72% of small businesses report using financial software to track their expenses and income, with 57% of businesses stating that it helps them make more informed financial decisions. (Source: Small Business Trends)

Why Choose Financial Fusion?

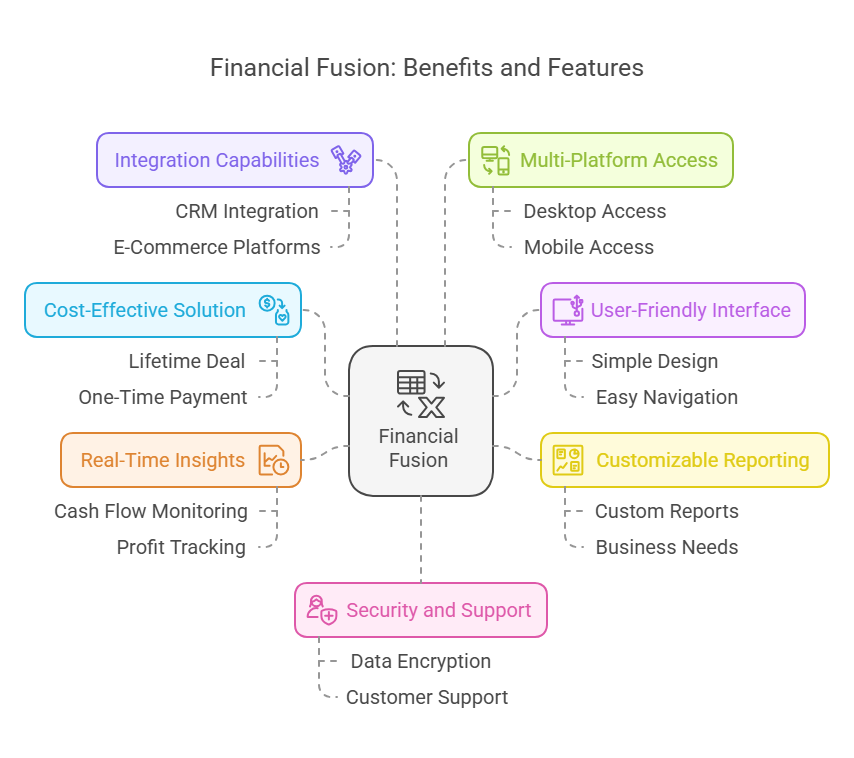

Cost-Effective Solution for Small Businesses

The lifetime deal model is one of the biggest reasons to choose Financial Fusion. Small businesses often face budget constraints, and recurring software subscriptions can add up. With a lifetime deal, you pay once and get access to the software forever. This eliminates the need to worry about monthly or annual fees, saving you money in the long run.

Easy-to-Use Interface

Financial Fusion is designed with simplicity in mind. Even if you’re not an expert in finance or accounting, the software is intuitive and easy to use. It has a user-friendly interface that allows you to track your income, expenses, and profits without getting lost in complicated features.

Customizable Reporting

Financial Fusion allows you to generate custom reports that suit your business needs. Whether you need balance sheets, income statements, or cash flow reports, you can create reports that are tailored to your business. These reports help you understand where your money is going and make informed financial decisions.

Real-Time Financial Insights

With Financial Fusion, you get real-time financial data. This means you can monitor your cash flow, profits, and expenses at any moment. Having up-to-date financial information is critical for making quick decisions and ensuring your business remains on track.

Comprehensive Financial Management Tools

Financial Fusion provides a variety of financial tools that cover all aspects of business management. From invoicing and budgeting to financial forecasting and tax planning, this software has everything you need to stay organized and efficient.

Seamless Integration with Other Tools

Financial Fusion integrates easily with other business tools, such as CRM software, project management systems, and e-commerce platforms. This makes it easy to manage all aspects of your business from one central hub.

Features of Financial Fusion

Multi-Platform Access

Whether you are at the office or working from home, Financial Fusion allows you to access your financial data from anywhere. The software is available on desktop and mobile platforms, giving you the flexibility to manage your business finances on the go.

Automatic Backups

With Financial Fusion, you don’t have to worry about losing your financial data. The software automatically backs up your information, ensuring that you never lose important records.

Customer Support

If you ever run into issues or need assistance, Financial Fusion offers robust customer support. Their team is available to help you resolve any problems quickly and efficiently.

Security

Financial data is highly sensitive, and Financial Fusion takes security seriously. The software uses advanced encryption protocols to protect your financial information from unauthorized access.

Benefits of the Lifetime Deal

No Recurring Costs

Small businesses often have limited cash flow, and recurring costs can strain budgets. The lifetime deal eliminates the need for ongoing monthly or annual payments. Once you pay for the software, you’ll have lifetime access without worrying about subscription fees.

Predictable Expenses

With the lifetime deal, you can predict your business expenses with certainty. There are no hidden fees or surprise renewals—what you pay initially is all you need to spend.

Long-Term Value

Investing in a lifetime deal ensures long-term value. You can continue using Financial Fusion without worrying about software upgrades or future price increases. This is an excellent investment for your business.

How Financial Fusion Helps Small Businesses

Small businesses face numerous challenges, from managing cash flow to tracking expenses. Financial Fusion helps streamline many of these processes, making it easier for business owners to focus on growth. Here’s how it benefits small businesses:

Saves Time

With Financial Fusion, manual tasks like bookkeeping, tax calculations, and financial reporting are automated. This saves you valuable time, allowing you to focus on other important aspects of your business.

Improves Decision-Making

Having access to accurate, real-time data enables you to make informed decisions. Whether you’re deciding on investments, hiring staff, or scaling your business, having clear financial insights is crucial for smart decision-making.

Helps with Tax Compliance

Tax laws can be confusing, but Financial Fusion makes it easier to manage your business’s taxes. The software helps you stay compliant by tracking expenses and providing accurate financial reports.

Supports Growth

As your business grows, your financial needs will become more complex. Financial Fusion scales with your business, providing the tools and insights you need to manage larger operations.

How to Get the Financial Fusion Lifetime Deal

Securing the Financial Fusion Lifetime Deal is straightforward. Follow these detailed steps to begin using this powerful financial management software for your small business:

Visit the Website

The first step in securing the Financial Fusion Lifetime Deal is to visit the official website. This is where you’ll find all the details about the software, the features it offers, and the available pricing plans. Once you’re on the website, take your time to explore the platform, learn about its capabilities, and ensure it’s the right solution for your business needs.

You can access the official website directly from any search engine or by following a link provided by the Financial Fusion marketing or affiliate partner.

Select the Lifetime Deal

Once you’re on the website, you’ll find a page dedicated to lifetime deal plans. There may be several different plans available depending on the size and complexity of your business. These plans are typically categorized based on the number of users, business features, and customization options. Some of the common tiers for small businesses might include:

- Basic Plan: This may offer essential features for startups and very small businesses.

- Standard Plan: Ideal for growing businesses that need advanced features such as custom reporting and integration options.

- Premium Plan: The most robust option, suitable for businesses that need full financial automation, multi-platform support, and high-level customization.

Look at the features offered with each plan to make an informed choice based on your business’s needs. You may also see details about available customer support and the possibility of future updates.

Pay Once

After selecting your desired plan, the next step is to make a one-time payment. Financial Fusion follows a lifetime deal model, which means you’ll pay for the software only once. This eliminates the burden of recurring monthly or annual subscription fees.

Here’s what you should expect during the payment process:

- Secure Payment Gateway: The website will direct you to a secure payment page. Financial Fusion offers multiple payment methods, including credit/debit cards and other online payment systems like PayPal.

- Clear Pricing: Be sure to check the total price, which will include the plan cost and any additional fees. Since the lifetime deal offers long-term access, the price is typically a one-time fee that provides access to all features for life. Double-check the plan details to confirm that it aligns with your business requirements.

- Tax Information: Depending on your location, taxes may be applied to the purchase. These taxes will be clearly displayed during the checkout process.

Once payment is confirmed, you’ll receive a receipt with your purchase details, ensuring the deal is locked in for your lifetime access.

Start Using the Software

After completing the payment, you’ll immediately receive access to Financial Fusion. The process will include:

- Account Setup: You’ll be guided through an easy setup process. You may need to create an account using your email and set up your business profile. This will allow you to personalize the software according to your business needs.

- Installation and Integration: Depending on your chosen plan, you may either get a cloud-based login or a downloadable version for your desktop. If you choose the cloud-based version, you can start using Financial Fusion immediately from your browser. The installation process is simple, with detailed instructions provided. You can integrate it with your existing business tools, such as CRM systems or payment platforms.

- Getting Started Tutorial: Many financial software platforms, including Financial Fusion, offer a walkthrough or tutorial upon first use. This will help you understand how to navigate the system, enter your business data, and begin generating reports. The tutorial is often designed for users with limited financial expertise, so you don’t need to worry if you’re new to financial software.

With these simple steps, you’ll have full access to Financial Fusion and can start using it to streamline your business finances right away!

Remember, the lifetime deal means that you’ll be able to use the software for as long as you need, without worrying about ongoing payments. You can also expect occasional updates and support to ensure that you’re always getting the most out of the software.

By securing the Financial Fusion Lifetime Deal, you’re investing in a long-term solution for your business’s financial needs, allowing you to focus on what truly matters: growing your business.

FAQs About Financial Fusion Lifetime Deal

1. What is the Financial Fusion Lifetime Deal?

The Financial Fusion Lifetime Deal is a one-time payment option that gives you lifetime access to the software. You won’t need to pay recurring fees for continued usage.

2. Is Financial Fusion suitable for small businesses?

Yes, Financial Fusion is designed specifically for small businesses, with features that help manage finances, improve reporting, and streamline financial tasks.

3. Can I integrate Financial Fusion with other tools?

Yes, Financial Fusion integrates with various business tools such as CRM systems, e-commerce platforms, and project management software.

4. Does Financial Fusion offer customer support?

Yes, Financial Fusion offers reliable customer support to help you with any issues you encounter.

5. Is the Financial Fusion Lifetime Deal a good investment for small businesses?

Yes, it’s an excellent investment, especially for small businesses that want to avoid ongoing subscription fees and enjoy long-term value.

The Financial Fusion Lifetime Deal is an invaluable tool for small businesses looking to streamline their financial processes. With its cost-effectiveness, ease of use, and comprehensive features, Financial Fusion offers the perfect solution to manage your business finances with clarity. By investing in the lifetime deal, you save money on recurring costs and gain access to powerful financial tools that will grow with your business.